AML Compliance – Make KYC a Competitive Advantage

Make AI Driven KYC Your Competitive Advantage!

Making sense of AML Compliance and KYC risk through streamlining programs is your Superpower!

We often hear the phrase “risk-based approach” in the context of an effective AML program. What exactly is a “risk-based approach”?

A strong Risk Assessment approach is the foundation of any organization’s AML Compliance and KYC program. It typically consists of two main components: assessing your organization’s risk profile and assessing the potential that your customers could engage in criminal activity.

Our view at MinervaAI is that it’s the second piece – understanding the customer within the context of the world they operate in – that’s most critical. It’s the customer risk potential that drives all the other components of AML, including the depth and frequency of customer monitoring.

That’s the “risk-based” part of it; taking a focused approach to managing your relationships with your customers depending on the level of risk they present to your organization.

If we understand anti-money laundering (AML) risk more deeply at onboarding, then we lower the risk of letting a criminal through the front door in the first place. We do a better job of selecting customers who are going to have a long, healthy relationship with us and who will be more profitable over the long term – which is the ultimate goal.

Many organizations struggle with the customer side of AML risk assessment, either scoring customers too high or too low on the risk scale. What’s the cause of this and how can we avoid it?

Many of our customers face this pain point in their KYC processes. The problem manifests at the very start of the customer relationship lifecycle.

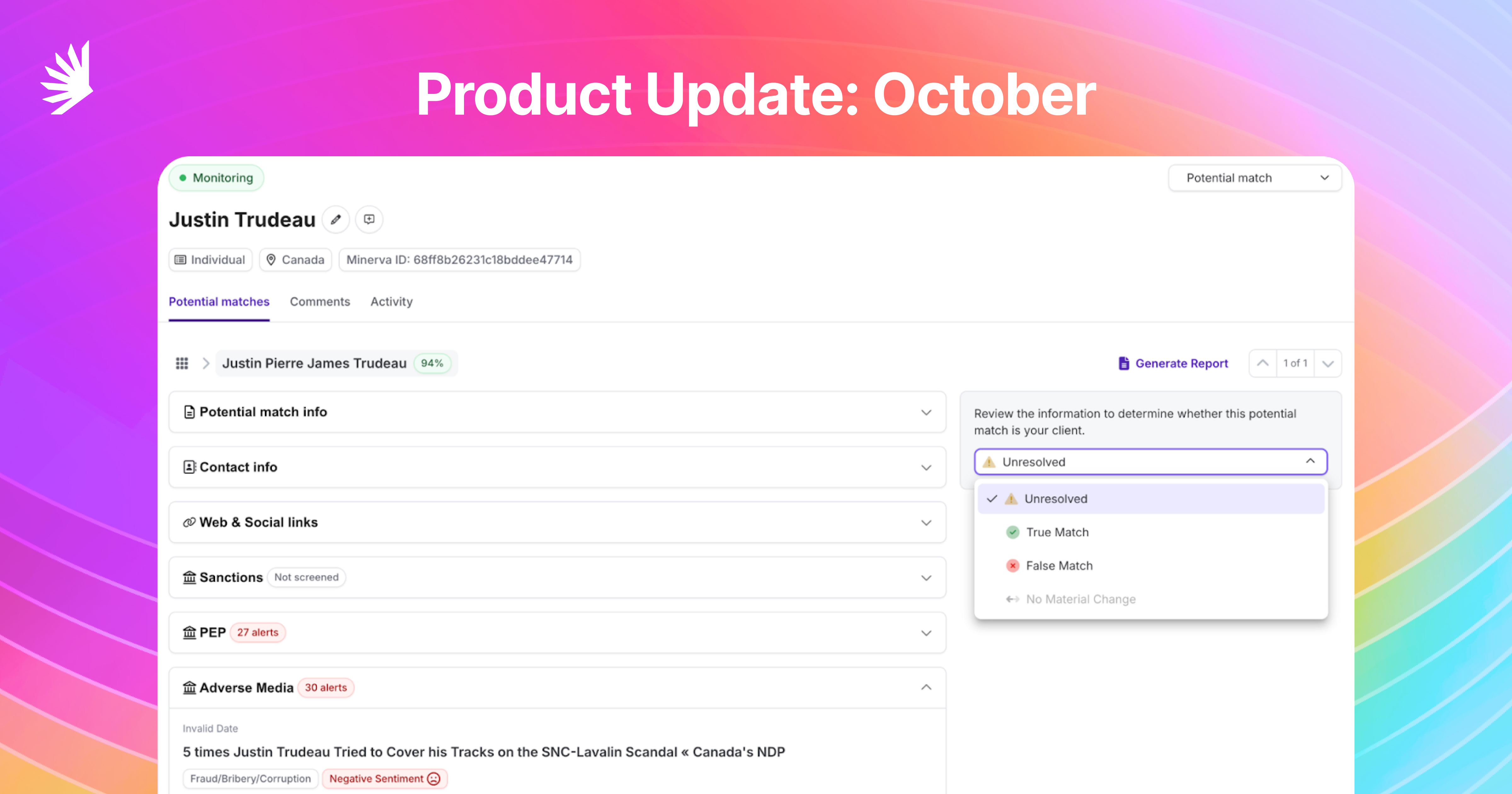

An AML centric Customer Risk Rating (CRR) is normally assessed in two phases, first at onboarding and then throughout your relationship with the customer depending on the customer’s prescribed level of risk.

Traditionally, CRR at onboarding is pretty cursory consisting only of ID validation, a credit check and a few other things. It’s very limited to the basic identification elements blended with your organizational factors. At this point, the assessment outcome really isn’t about financial crime risk because it doesn’t go very deep and because you don’t have a preexisting relationship with the customer to understand patterns of financial behaviour. The risk rating that’s going to come out of that is going to be pretty light because there’s not a lot to go on.

When we worked with investigations teams to streamline their processes, we found the level of information collected at onboarding wasn’t enough for the teams to form a solid, consistent risk assessment. There was either not enough contextual information (legal, criminal, social, averse media etc.) and/or the information was limited because it was collected and assessed manually. The second key challenge was the inconsistent way in which the organization’s AML Compliance and KYC risk policy was applied by individual investigators. These two factors are at the heart of the over/under scoring problem.

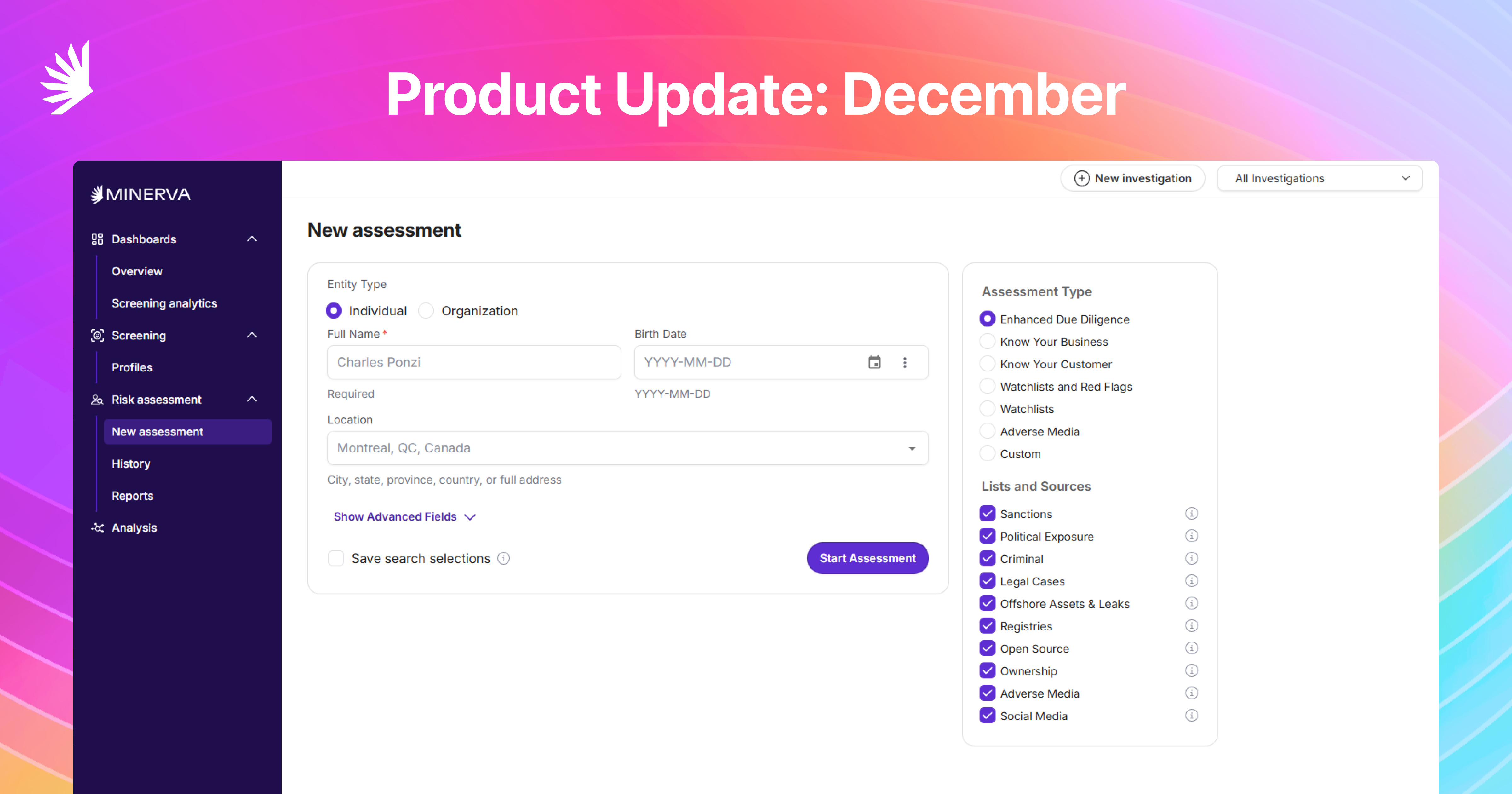

The genesis of MinervaAI was based on three needs: the need for a comprehensive and efficient way to gather meaningful information, the need to refocus investigators on risk analysis rather than data collection, and the need for consistency in outcomes. By taking advantage of the deep learning algorithms unique to MinervaAI organizations can seamlessly access a full view of the customer right at onboarding and apply an appropriate level of monitoring commensurate to the risk.

The genesis of MinervaAI was based on three needs: the need for a comprehensive and efficient way to gather meaningful KYC information, the need to refocus investigators on risk analysis rather than data collection, and the need for consistency in AML outcomes.

You work very closely with Payment services, Crypto-Exchanges, and Wallets. What problems are unique to those services and challenger banks?

Effective AML Compliance and KYC starts with more than just identification, it’s about understanding the customer, the context in which they operate and who they are associated with. I think this aspect of an organization’s AML risk assessment approach becomes more important as our FinTech sector continues to grow.

The new players in this arena are very product specific or niche. Services like Crypto Exchanges or Payments processors are a perfect example. Under traditional risk assessment standards, they could be considered inherently high risk simply due to the products they offer and the types of transactions they facilitate. Having risk thresholds that are too tight leads to an unmanageable case load that returns little to no value leading to unnecessary bottlenecks and backlogs that are costly to manage, and inaccurately reflect risk. This is a less than optimal customer experience and can really deter competition and interrupt innovation.

By taking an intelligence-based customer-centric view on AML risk, these organizations can effectively manage throughput at onboarding, freeing up resources to focus on other important functions and avoiding expensive backlogs.

By empowering your team with intelligent tools they can eliminate much of the “busy-work”; to dig deeper in order to make better risk decisions more quickly.

It can take a serious mind-set shift in an organization to move toward a risk-based approach and embrace external information in the KYC process.

Having been the champion of change at some of Canada’s largest banks, what recommendations do you have for investigation units embarking on their own transformation?

At the heart of any AML program is the investigations team. It’s critical that the team understands their purpose – the true goals of the AML program and their role in achieving those goals.

Here’s a typical scenario where things tend to go wrong. Many current state models have the investigator tapping into whatever vendor or in-house systems they’re currently using to look at Sanctions and Politically Exposed Persons (PEPs) and maybe another system for adverse media. Then, they go out and execute a series of Google searches (client name in a public search engine -WHAT??) where they take what information they find and manually cut & paste it into a document. At the end of the day, they have a huge document with a billion pieces of information that are not connected and not relevant to the discussion of financial risk at all. What are the chances of successfully navigating that information and arriving at a consistent outcome every single time across a large team of analysts? I would say very slim indeed.

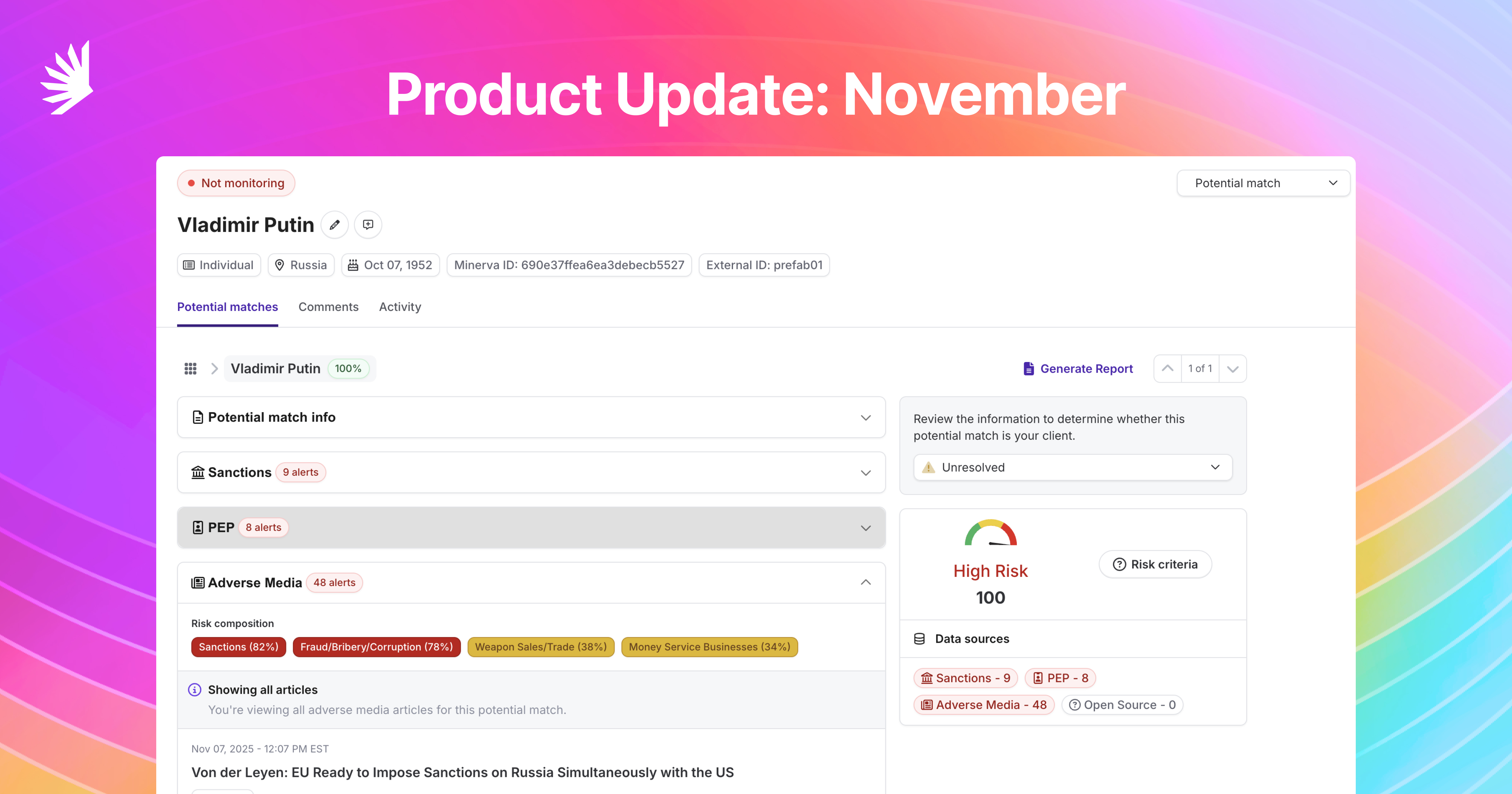

MinervaAI’s media risk sentiment analysis

That, in itself, is a high-risk process. Everyone’s coming to the table with their own understanding and interpretation of risk. It’s only when you give information back to an analyst that contains context, appropriate sentiment, and a view on risk presented in the same way every time, will they learn to develop their sense of what your organization’s risk appetite is and act on the organization’s behalf. It’s a really hard thing to do when you’re armed only with a search engine as a tool. The role of the investigator in these scenarios becomes very menial and task driven. The focus is on productivity, not risk.

By empowering your team with intelligent tools like MinervaAI, they can eliminate much of the “busywork”; to dig deeper in order to make better risk decisions more quickly. It renews the real purpose of the investigator – to assess risk effectively and efficiently on behalf of the organization, its customers and stakeholders. Taking out the manual tasks helps the team focus on why they do what they do and who they are helping by spending their time uncovering drug trafficking, human trafficking, corruption, and terrorist financing – not copying and pasting redundant reports.

…by using intelligent tools like MinervaAI, firms could start doing business with the right customers, much faster than their competitors. That’s the competitive advantage.

Cost burden and attracting the right resources is still a huge problem for entrants and incumbents alike, but you’ve often made the case that a consistent, risk-based approach to AML Compliance and KYC can be a competitive advantage for financial services businesses. Explain!

Yes, I truly believe that!

If we build on the previous example where traditional risk assessments are costly and time consuming, contributing to unnecessary friction at customer onboarding and throughout the relationship – and turn that into a real-time experience by using intelligent tools like MinervaAI, firms could start doing business with the right customers, much faster than their competitors. No more holding assets or customer activity until a lengthy due diligence exercise can be completed!

Could you imagine how different it would be to work on an AML team where you were actually seen as a partner to revenue generation?

If you’d like to know more about how Minerva can help you more effectively assess risk, we'd love to talk - book a time with us here.

Download the guide

Download this Resource

Stay a step ahead with insights and updates from Minerva

Explore more

All-In-One, AI-Enhanced Risk Screening

We put the world’s data to work on a comprehensive compliance platform.

Discover more efficient, effective investigations.