Implementing the Crypto Travel Rule: A guide for virtual asset providers and traditional banks

If you went to send a wire transfer, you had to fill out paperwork and provide all sorts of information to the bank before the money was sent. That’s because the bank needed to confirm both your identity, and the identity of the recipient, before allowing any transaction to go through.

That’s the travel rule in action. The bank is performing the required activities for KYC (know your client) under AML regulations, to ensure that money is not changing hands between restricted parties or for nefarious purposes. These security checks are so behind-the-scenes that the customer simply takes them for granted.

Yet in the crypto space, the sender’s and recipient’s identities aren’t government IDs and passports, but instead a 35 character code; so confirming the security of the value changing hands is a whole other ballgame.

The law is just now catching up, and the Financial Action Task Force (“FATF”) has evolved the travel rule to apply to virtual assets, and has provided updated guidance as of June 20, 2022. However, while countries have vowed to implement their own laws, not every government is on the same page.

What happens if one country that has security standards is attempting to send money to a citizen, or even government of a country that does not? How do crypto providers manage differing transactional thresholds and rules for unhosted wallets while still following data privacy regulations? What are the considerations for traditional financial institutions who are the on-ramps and off-ramps for crypto service providers?

In this guide, we take a closer look at how the travel rule works for crypto, how it plays out in Canada, the US, and abroad, and how to operationalize Travel Rule compliance.

Download the guide

Download this Resource

Stay a step ahead with insights and updates from Minerva

Explore more

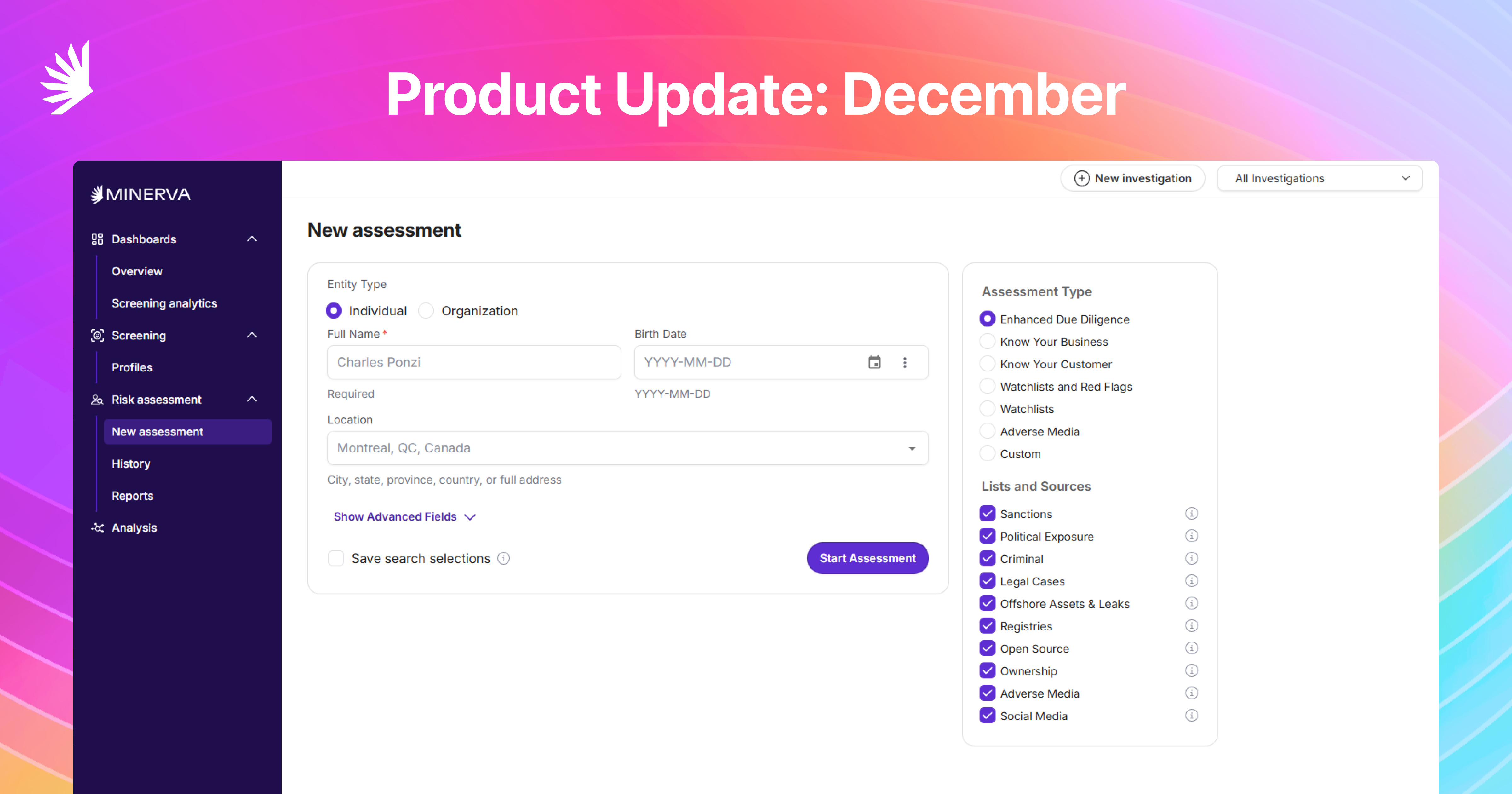

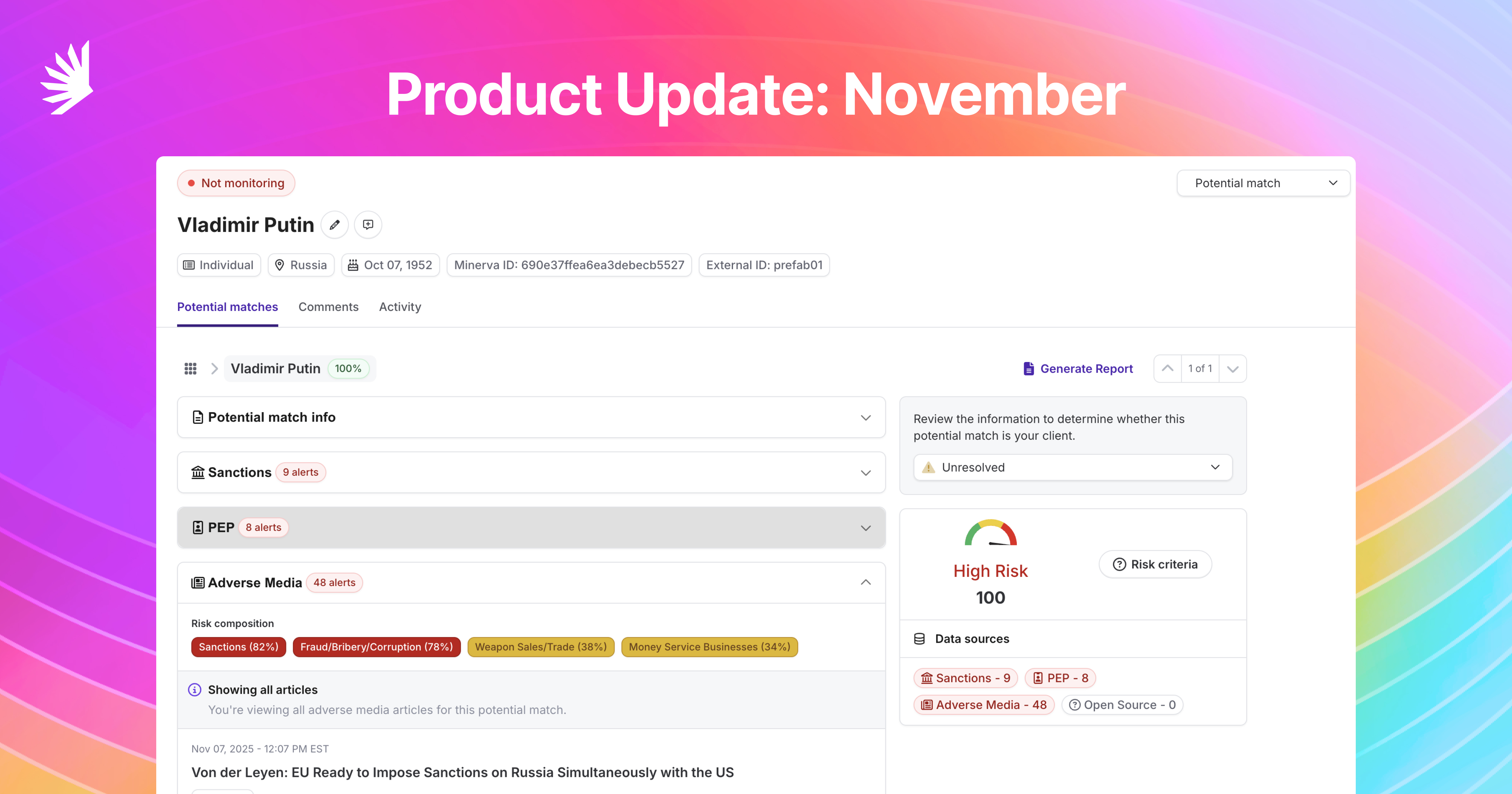

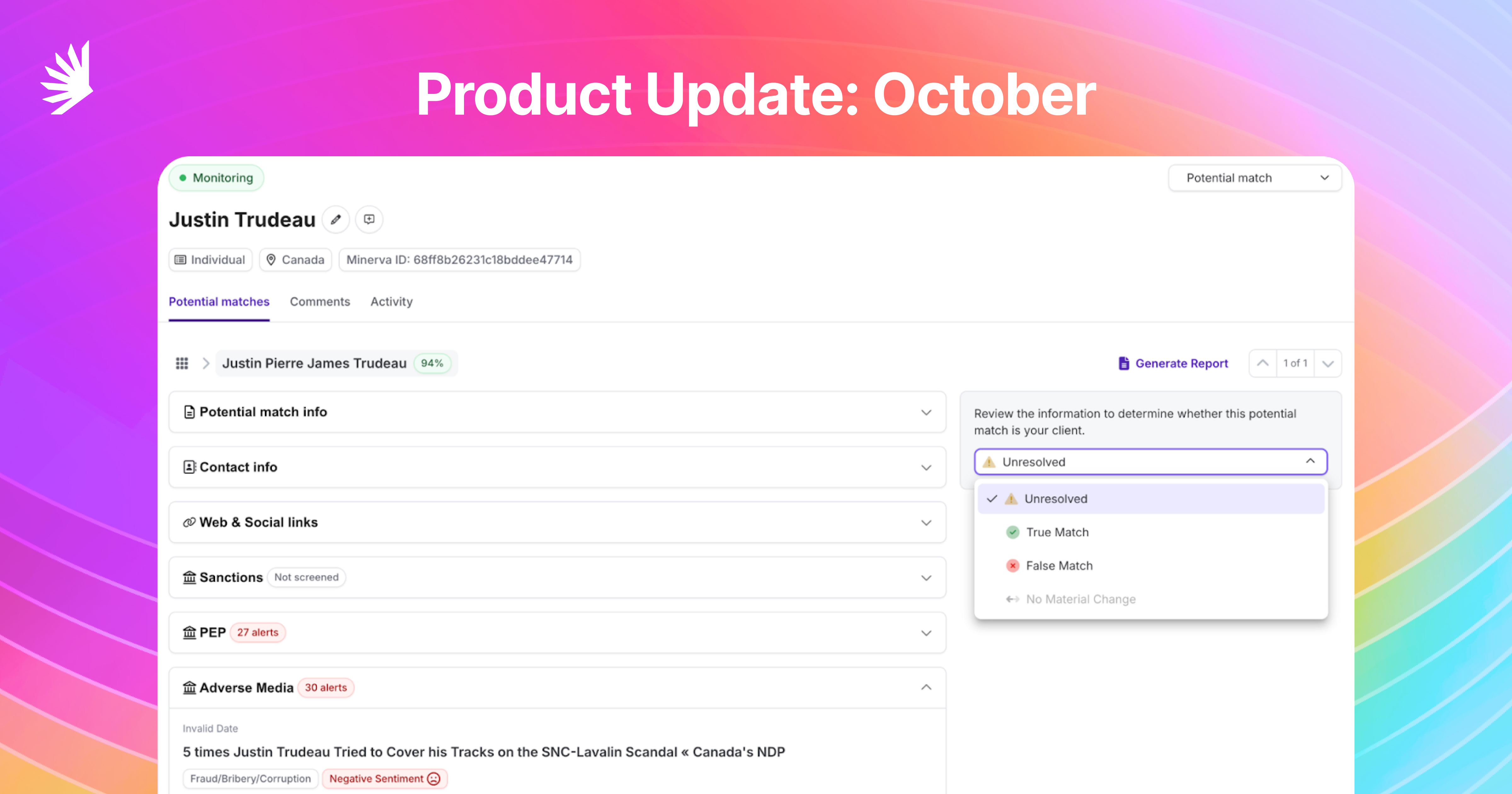

All-In-One, AI-Enhanced Risk Screening

We put the world’s data to work on a comprehensive compliance platform.

Discover more efficient, effective investigations.